By Ana Pereira Toronto Star Staff Reporter

Monday, December 4, 2023

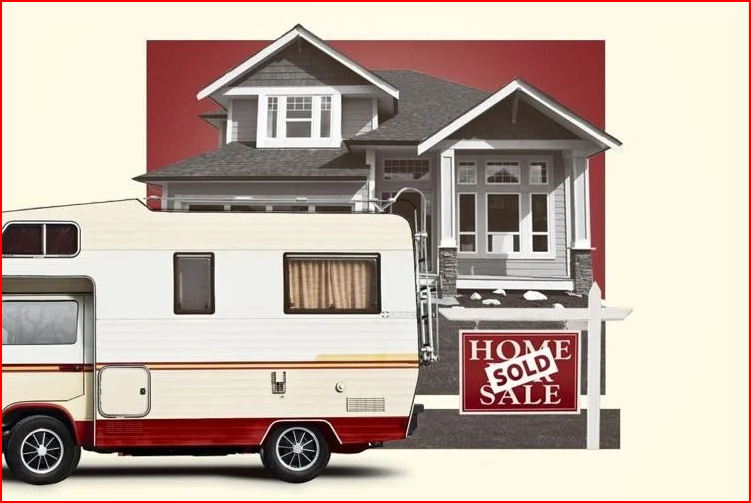

Ramon Ferreira / Star photo illustration The Star

One spring six years ago, Peggy Dent, 72, and her partner Annette Dusa, 63, said goodbye to the home they had lived in for 12 years.

The two-story, neocolonial house in Oregon, U.S., was too big for the two of them, they realized. It was also, Dent says, constantly draining their finances and energy.

“We felt like slaves to the bank,” she said, “we were paying them to live in it.”

So they closed a deal on the property for $550,000 (U.S.), pocketed what was left from the sale and drove to Winter Garden, Fla. in search of a new home.

But instead of going to an open house, Dent and Dusa wound up at an RV dealership making a life-changing decision. They became full-time residents of a brand new 38-foot Newmar motorhome.

Ever since, the semi-retired couple and their dogs have been on the road exploring beautiful sights from the Maritimes to British Columbia.

“The weight of taking care of the house became overwhelming compared to the desire to just leave it behind and do something else,” Dent said. “We were in a place in our lives where things weren’t holding us down anymore. So, we thought, ‘let’s get on the road and see the parts of the country we haven’t seen yet.’”

They’re not alone. More seniors are considering radical lifestyle changes as inflation and mortgage costs erode retirement savings. Some are selling their homes and relocating to more affordable cities, others are moving in with their children. And a growing number of retirees are embracing ‘van life,’ a simpler way of living and travelling that is typically associated with adventurous 20-year-olds from Vancouver.

Majority of Canadians will need to sacrifice in retirement

“We’re really seeing a boom,” especially from retirees looking for new experiences, said Shane Devenish, president of the Canadian RV Association (www.crva.ca), a non-profit organization that works closely with industry stakeholders to develop standards and codes for recreational vehicles.

“I hear people talking about doing it for a year or two and then selling the unit,” he said “and others love the lifestyle — they stay in it.”

In 2021, global market research firm Ipsos reported that out of full-time RV users in the U.S., 35 per cent were over 55 and nearly half were retired.

In Canada, Ipsos found that 17 per cent of RV users (full-time or seasonal) were 55 or older in 2023. Meanwhile, the number of overall users has been growing: First-time RV purchases doubled over the last two years, from six per cent in 2021 to 12 per cent in 2023.

While some might romanticize the frugality of ‘van life,’ which values experiences and not things, more retirees will be forced to make sacrifices like downsizing to afford retirement.

A study by Deloitte of 4,000 retirees and near-retirees — between the ages of 55 and 64 — showed that 55 per cent of Canadians heading into retirement will have to make significant lifestyle compromises to avoid outliving their savings.

“A lot of retirees are actually going to at least be able to meet that bare minimum lifestyle, or low income, by relying on government programs,” said Hwan Kim, partner at Deloitte Canada and co-author of the study. “But that’s a pretty low bar.”

Canadians are living longer than anticipated

It’s middle class Canadians who are not going to be able to meet their expectations for retirement, and might even be pushed into the low income group, Kim said.

“This is a population that will certainly live in anxiety about unexpected costs because they don’t have the buffer,” he added.

Part of the reason is that Canadians are living longer than anticipated. Seniors are also increasingly dependant on their homes for wealth, according to the report. Relying on real estate is risky because it is less liquid (harder to turn into cash), and the market is volatile.

Home equity comprised 46 per cent of Canadians’ net assets in 2019 compared to 38 per cent in 1999, the report said. Meanwhile, housing prices increased by more than 318 per cent from 2000 to 2020.

The authors suggest current near-retirees need to have saved at least $340,000, including pension savings, to be able to afford a modest lifestyle until the average Canadian life expectancy of 82.

Sara McCullough, an Ontario-based certified financial planner, says retirees shouldn’t count on the value of their homes when planning for retirement. Aside from the uncertainty of moving somewhere unknown, it can be hard to emotionally let go of a place full of memories.

“What I’ve noticed is, when clients are in a place that they’re not comfortable, they start spending more money,” she said, “It’s stress spending.”

Sometimes, moving doesn’t give us what we want financially

Downsizing can also be expensive, as tenants are increasingly subjected to ‘renovictions’ and skyrocketing rents, she said.

Dent and Dusa know a thing or two about the challenges of navigating new spaces and leaving precious belongings behind.

It can be frustrating having to go to new grocery stores on the road that don’t have the things you like, Dent said.

One of the hardest parts of their move was deciding whether to sell furniture that was handmade by Dent’s father. In the end, they kept it in a storage unit, which costs them a couple hundred dollars a month.

Sometimes, moving doesn’t give us what we want financially, McCullough said.

Those who are forced to make radical lifestyle changes can consider finding creative ways to keep those memories alive, she added.

“You can do some amazing things with digital art,” said McCullough, suggesting perhaps Dent could take pictures of her father’s beloved gift, and create a “wall of furniture.”

Ana Pereira is a Toronto-based general assignment reporter for the Star. Reach her via email: anpereira@thestar.ca

- La National Highway Traffic Safety Administration (NHTSA) a émis les rappels suivants concernant les fabricants de véhicules récréatifs – 8 avril, 2024 - April 2, 2024

- La National Highway Traffic Safety Administration (NHTSA) a émis les rappels suivants concernant les fabricants de véhicules récréatifs – 25 mars 2024 - March 25, 2024

- National Highway Traffic Safety Administration (NHTSA) a émis les rappels suivants concernant les fabricants de véhicules récréatifs – 11 mars, 2024 - March 11, 2024